5 Reasons Why Saving Money in Nigeria Won’t Make You Rich

5 Reasons Why Saving Money in Nigeria Won’t Make You Rich

Many Nigerians believe that diligently saving money represents the path to financial prosperity. While maintaining savings demonstrates financial discipline, relying solely on traditional savings strategies in Nigeria’s current economic climate will not generate the wealth you desire. The harsh reality is that inflation erodes purchasing power faster than most savings accounts accumulate interest, leaving savers poorer despite growing account balances.

Building genuine wealth in Nigeria requires a fundamental shift from passive saving to active wealth creation through strategic investments in yourself, your skills, your presentation, and entrepreneurial ventures.

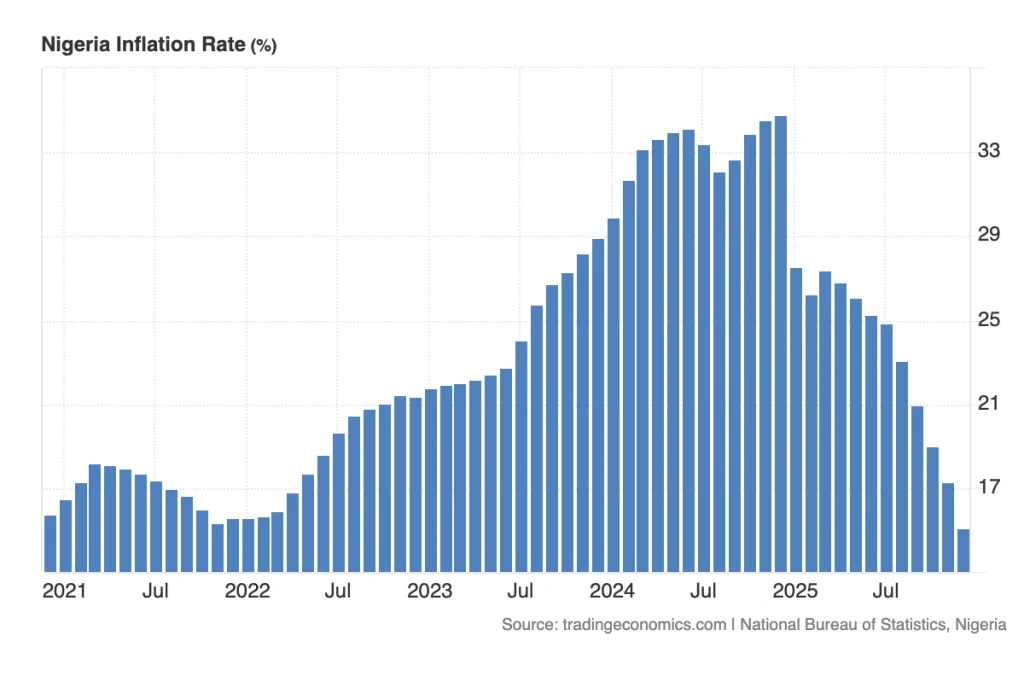

1. Inflation Destroys the Value of Your Savings

Nigeria’s inflation rate presents the most significant threat to traditional savings strategies. The Central Bank of Nigeria projects inflation to moderate to approximately 12.94% in 2026, down from an estimated 21.26% in 2025. While this represents improvement, double-digit inflation still devastates the real value of saved money.

Consider this scenario: If you save ₦1,000,000 in a traditional savings account offering 5% annual interest, your balance grows to ₦1,050,000 after one year. However, with 12.94% inflation, you would need ₦1,129,400 to purchase the same goods and services you could buy with ₦1,000,000 today. Despite “saving” money, you have actually lost ₦79,400 in purchasing power.

The Solution: Rather than allowing inflation to silently steal your wealth, redirect funds toward inflation-beating investments such as skills acquisition, business development, and income-generating assets. Your money must work harder than inflation to preserve and grow your wealth.

2. You Need to Invest in Education and Skills Development

The most valuable investment you can make is in yourself. Education and continuous skills development create income-generating capabilities that compound over time, unlike stagnant savings that depreciate through inflation.

Nigeria’s evolving economy rewards specialized knowledge and high-demand skills. Professionals with expertise in technology, digital marketing, data analysis, financial management, and other sought-after fields command premium salaries and enjoy greater career mobility. The income differential between skilled and unskilled workers continues to widen, making education and training essential for wealth creation.

Strategic Investment Areas:

- Professional Certifications: Obtain recognized certifications in your field (project management, accounting, IT, etc.)

- Digital Skills: Master in-demand digital competencies including coding, graphic design, content creation, and social media management

- Language Proficiency: Develop English fluency and consider learning additional languages to access international opportunities

- Industry-Specific Training: Pursue specialized knowledge that positions you as an expert in your sector

The return on educational investment far exceeds traditional savings returns. A professional certification costing ₦200,000 might enable you to increase your income by ₦100,000 monthly—a 50% return in just two months that continues generating returns indefinitely.

3. Your Appearance and Personal Brand Matter for Wealth Creation

While often overlooked in financial discussions, your appearance and personal presentation directly impact your earning potential and business opportunities. In Nigeria’s relationship-driven business environment, first impressions significantly influence professional advancement and entrepreneurial success.

Investing in your appearance does not mean frivolous spending on luxury items. Rather, it involves strategic expenditure on professional presentation that opens doors to higher-paying opportunities, valuable connections, and business partnerships.

Strategic Appearance Investments:

- Professional Wardrobe: Quality business attire appropriate for your industry and aspirations

- Personal Grooming: Consistent maintenance of professional appearance standards

- Health and Fitness: Physical wellness that projects energy, discipline, and capability

- Communication Skills: Training in public speaking, presentation, and interpersonal communication

Research consistently demonstrates that well-presented professionals receive preferential treatment in hiring decisions, promotion considerations, and business negotiations. The confidence gained from knowing you present yourself professionally translates into more assertive negotiation, stronger networking, and increased opportunities.

Consider this investment as building your personal brand—the unique value proposition you offer to employers, clients, and business partners. A strong personal brand commands premium pricing and attracts opportunities that remain inaccessible to those who neglect their professional presentation.

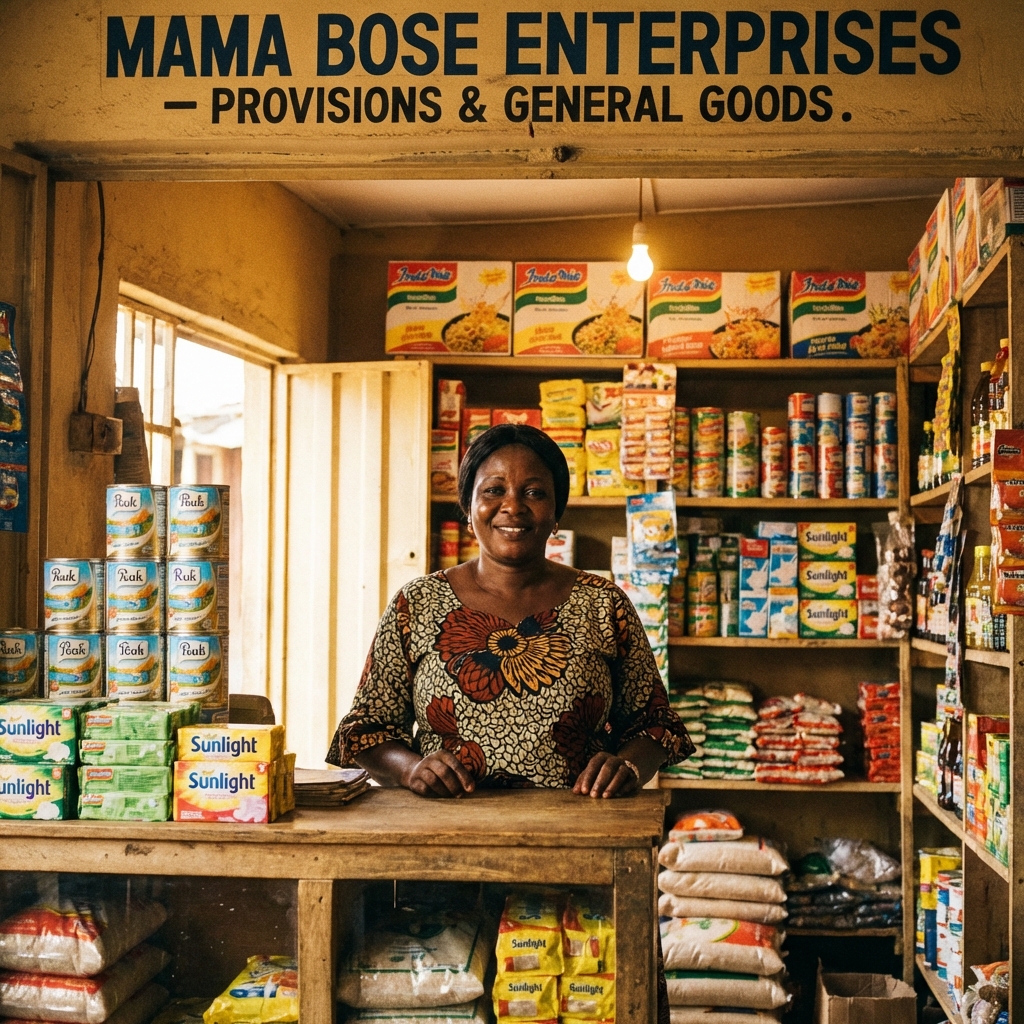

4. Building an Online Business Creates Scalable Wealth

Traditional employment, regardless of salary level, imposes income ceilings. You exchange time for money, creating a direct limitation on earning potential. Building an online business breaks this constraint by creating scalable income streams that grow beyond the hours you personally work.

Nigeria’s improving internet infrastructure and growing digital economy present unprecedented opportunities for online entrepreneurship. E-commerce, digital services, content creation, online education, and technology solutions represent viable pathways to substantial wealth creation.

Online Business Opportunities:

- E-commerce: Sell products through platforms like Jumia, Konga, or your own website

- Digital Services: Offer freelance skills (writing, design, programming, consulting) to global clients

- Content Creation: Build audiences through YouTube, blogs, or social media and monetize through advertising, sponsorships, and product sales

- Online Education: Create and sell courses teaching valuable skills to others

- Affiliate Marketing: Earn commissions promoting other companies’ products and services

The beauty of online businesses lies in their scalability. A digital product created once can sell thousands of times without proportional increases in effort. A service business can expand by hiring others to deliver services while you focus on growth and strategy.

Starting an online business requires minimal capital compared to traditional brick-and-mortar establishments. Many successful Nigerian online entrepreneurs began with less than ₦50,000, investing primarily in learning, basic equipment, and initial marketing.

5. Strategic Saving Enables Business Building, Not Wealth Itself

Saving money serves an important purpose—but not as a wealth-creation strategy. Instead, view savings as fuel for wealth-generating activities. Strategic saving means accumulating capital specifically to invest in business ventures, income-generating assets, or significant personal development opportunities.

The distinction is critical: passive saving for the sake of having money in the bank creates the illusion of financial progress while inflation silently erodes value. Active saving with a specific investment purpose transforms money into a tool for wealth creation.

Strategic Saving Framework:

1. Define Your Investment Goal: Determine exactly what you’re saving for (business startup capital, professional training, equipment purchase, etc.)

2. Calculate Required Amount: Establish the specific sum needed to achieve your investment goal

3. Set a Timeline: Create urgency by establishing a deadline for accumulating the required capital

4. Automate Savings: Arrange automatic transfers to prevent spending money earmarked for investment

5. Protect Against Temptation: Keep investment savings in a separate account to avoid using funds for consumption

6. Execute Promptly: Once you reach your target amount, immediately deploy the capital toward your planned investment

This approach transforms saving from a passive activity into an active wealth-building strategy. You’re not saving to have money; you’re saving to invest money in opportunities that generate returns exceeding inflation and creating lasting wealth.

Taking Action: Your Wealth-Building Roadmap

Understanding why traditional saving won’t make you rich represents the first step. Implementing alternative strategies determines whether you actually build wealth. Here’s your action plan:

Immediate Actions (This Month):

- Assess your current skills and identify high-value competencies to develop

- Research one online business model aligned with your interests and abilities

- Audit your professional appearance and identify areas for improvement

- Calculate how much inflation has eroded your savings over the past year

Short-Term Goals (Next 3-6 Months):

- Enroll in one professional development course or certification program

- Invest in upgrading your professional wardrobe and personal presentation

- Launch a minimum viable version of an online business or side venture

- Establish a strategic savings account with a specific investment purpose and target amount

Long-Term Vision (Next 1-2 Years):

-

- Develop multiple income streams through your online business and enhanced professional skills

- Build a personal brand that attracts premium opportunities

- Accumulate and deploy investment capital into scalable business ventures

- Achieve financial independence where your assets generate income exceeding your expenses

Conclusion

Saving money in Nigeria won’t make you rich because inflation destroys purchasing power faster than traditional savings accounts grow. The path to genuine wealth requires investing in yourself through education and skills development, enhancing your professional presentation and personal brand, building scalable online businesses, and using strategic saving as a tool for capital accumulation rather than wealth creation itself.

The Nigerian economy rewards those who create value, solve problems, and build income-generating assets. While your peers watch inflation silently steal their savings, you can be building skills, launching businesses, and creating multiple income streams that compound over time.

Wealth creation demands action, investment, and calculated risk-taking. Start today by identifying one area where you can invest in yourself, one skill you can develop, or one business idea you can test. Transform from a passive saver watching money lose value into an active wealth builder creating lasting financial prosperity.

The choice is yours: continue saving and watch inflation make you poorer, or start investing in yourself and building the wealth you deserve.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.