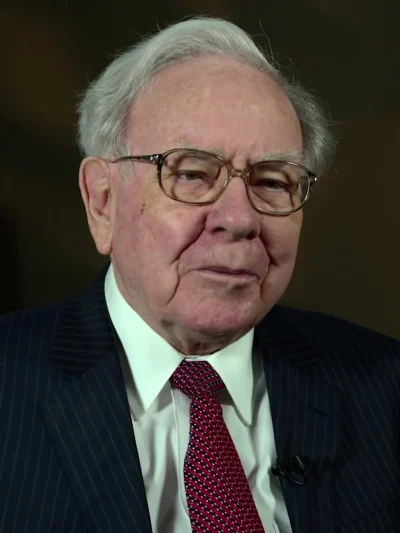

How Rich Is Warren Buffett?

How Rich Is Warren Buffett? The Story, Strategy, Partnerships, and Lessons Behind His Wealth

Warren Buffett, known as the Oracle of Omaha, is one of the wealthiest individuals on the planet, with a net worth that consistently exceeds $100 billion. His rise to immense wealth did not come from luck or inheritance. Instead, it came from disciplined value investing, lifelong learning, strategic partnerships, and the power of compound interest.

Warren Buffett’s Early Foundation

Buffett was born in 1930 in Omaha, Nebraska. From childhood, he displayed a strong interest in business, numbers, and investing. At just 11 years old, he bought his first stocks. Cities Service Preferred. His entrepreneurial ventures included selling newspapers, running pinball machines, reselling used golf balls, and operating small businesses.

By age 14, he had filed his first tax return. His youth demonstrates a rare combination of curiosity, discipline, and a passion for building capital.

How Warren Buffett Made His First $100,000

Buffett often said the first $100,000 is the toughest, and he reached it through:

Relentless compounding

He reinvested every dollar and obsessively calculated how money grows over time.

Frugal living

He saved aggressively by minimizing personal expenses.

Multiple income streams

He managed a paper route, sold items, and ran early entrepreneurial ventures.

Investment partnerships

Buffett created investment partnerships where he only earned fees if he outperformed the market.

By age 26, he surpassed $140,000, proving that his disciplined approach worked before he became famous.

The Charlie Munger Partnership: A New Way of Investing

The arrival of Charlie Munger changed Buffett’s strategy forever. Munger convinced him to pursue:

- High-quality businesses

- With durable competitive advantages

- Managed by excellent leaders

- Even if the stocks were not “cheap”

Munger introduced the principle of buying great companies at fair prices instead of mediocre companies at bargain prices. This evolution helped shape many of Berkshire’s most successful investments, including See’s Candies, Coca-Cola, American Express, and later Apple.

Buffett often said:

“Charlie Munger made me a better investor.”

How Berkshire Hathaway Became a Financial Colossus

Buffett originally bought Berkshire Hathaway, a textile company, because it was cheap. He later admitted it was a mistake, but he turned that mistake into a masterstroke by:

Transforming Berkshire into a holding company

He stopped textiles and used Berkshire to buy businesses.

Using insurance float

Insurance premiums provided billions of dollars to invest long before claims were due.

Acquiring full companies

Berkshire now owns major businesses like:

- GEICO

- Dairy Queen

- BNSF Railway

- Duracell

- Fruit of the Loom

- Precision Castparts

Investing in iconic brands

Berkshire holds significant stakes in:

- Apple

- Coca-Cola

- Bank of America

- Kraft Heinz

- Moody’s

Through this strategy, Berkshire evolved into a $700+ billion financial empire.

Warren Buffett Net Worth

Warren Buffett is one of the richest people in the world, with a net worth that consistently ranges between $100 billion and $120 billion, depending on market fluctuations. This immense wealth places him among the top global billionaires, often alongside figures like Elon Musk, Jeff Bezos, and Bernard Arnault.

Buffett’s fortune comes almost entirely from investing, not inheritance or entrepreneurship in the traditional sense. Through Berkshire Hathaway, he transformed a struggling textile company into a $700+ billion financial empire, giving him one of the most successful investment track records in history.

Why Warren Buffett’s Wealth Matters

Buffett’s fortune is not just impressive. It is educational. His wealth story demonstrates:

- The unmatched power of compounding

- The value of patience and consistency

- The importance of rational investing

- The benefit of buying quality companies and holding for decades

- The impact of low-risk, long-term decision-making

His entire net worth is a testament to the idea that ordinary people can build extraordinary wealth by applying simple, disciplined strategies over long periods.

Practical Tips to Invest Like Warren Buffett

You can apply Buffett’s principles today:

1. Invest in what you understand

Avoid hype. Choose industries you know.

2. Focus on intrinsic value

Buy undervalued or fairly priced quality businesses.

3. Reinvest consistently

Let compound interest work over decades.

4. Avoid unnecessary risks

Buffett’s Rule #1 and Rule #2 reflect the importance of protecting capital.

5. Think long-term

Buffett rarely sells. Patience produces wealth.

6. Live below your means

His modest lifestyle supports high investment rates.

7. Read constantly

He reads hundreds of pages daily.

8. Seek quality over quantity

A few excellent investments outperform many average ones.

9. Surround yourself with smart partners

Charlie Munger made Buffett vastly more successful.

10. Stay emotionally stable

Markets fluctuate. Your discipline should not.

7. Frequently Asked Questions (FAQ)

1. How rich is Warren Buffett today?

His net worth typically ranges from $100 billion to $120 billion.

2. What investment made Buffett rich?

The most transformative investments include See’s Candies, Coca-Cola, and Apple, supported by insurance float.

3. Is Warren Buffett self-made?

Yes. Nearly all of his wealth came from disciplined investing, not inheritance.

4. What was his biggest lesson from Charlie Munger?

Buy great companies, not just cheap ones.

5. Can beginners follow Buffett’s strategy?

Yes. His approach emphasizes simplicity, patience, and long-term thinking.

Conclusion

Warren Buffett’s story shows that wealth comes from discipline, strategy, and decades of compounding. From his humble beginnings to earning his first $100k, learning under Ben Graham, partnering with Charlie Munger, and building Berkshire Hathaway into a financial giant, Buffett proves that anyone. Regardless of background—can build lasting wealth through consistent, rational investing.

His principles are timeless: stay patient, stay rational, and let your money grow quietly in the background.

Follow his blueprint, and you can transform your finances just as he did.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.