Instant Salary Loans in Nigeria Without Collateral

Instant Salary Loans in Nigeria Without Collateral: The 2026 Ultimate Guide

In the dynamic financial landscape of Nigeria in 2026, the need for quick liquidity has never been more pressing. Whether it’s an unexpected medical bill, a last-minute school fee payment, or simply bridging the gap before the next payday, access to credit is essential. One of the most significant shifts in the Nigerian banking sector over the past few years has been the democratization of credit through instant salary loans without collateral.

For many Nigerians, the days of providing physical assets like land documents or car titles to secure a small loan are over. Today, your employment status and digital footprint are the new collateral. In this comprehensive guide, we will explore everything you need to know about obtaining an instant salary loan in Nigeria, the best platforms to use in 2026, and how to manage your debt effectively.

What are Instant Salary Loans Without Collateral?

Instant salary loans, often referred to as “PayDay Loans” or “Advance Credits,” are short-term financial facilities provided to individuals who are gainfully employed. The defining feature of these loans is that they are unsecured, meaning you do not need to provide any physical asset as security.

Instead, lenders use your Bank Verification Number (BVN), credit history, and salary records to determine your creditworthiness. In 2026, the application process is almost entirely digital, taking place via mobile apps, USSD codes, or web portals, with funds often disbursed in less than five minutes.

Why 2026 is the Year of Digital Credit in Nigeria

The Nigerian financial technology (Fintech) space has matured significantly. Several factors make it easier than ever to get a loan today:

1. AI-Driven Credit Scoring: Banks and Fintechs now use advanced algorithms to analyze your transaction history and predict your ability to repay.

2. Open Banking Initiatives: With better data sharing between financial institutions, lenders can quickly verify your income across multiple accounts.

3. USSD and Mobile Dominance: Even without a smartphone, Nigerians can access instant credit via simple shortcodes.

Top 7 Platforms for Instant Salary Loans in Nigeria (2026)

If you are looking for a reliable, fast, and collateral-free loan, these platforms are leading the market in 2026:

1. Access Bank (PayDay Loan)

Access Bank remains a heavyweight in the digital lending space. Their PayDay Loan is famous for its speed and lack of “paperwork.”

- How to Apply: Dial *901*11# or use the QuickBucks App.

- Max Amount: Up to 75% of your monthly salary (capped at ₦2,000,000 for high earners).

- Repayment: Usually deducted automatically once your salary hits your account.

2. First Bank of Nigeria (FirstCredit)

First Bank’s digital lending solution, FirstCredit, is designed for those who need money “now.”

- Requirement: Your account must have been active for at least six months.

- How to Apply: Dial *894*11# or use the FirstMobile App.

- Loan Limit: Ranges from ₦1,000 to ₦300,000.

3. FairMoney

As one of Nigeria’s most popular digital banks, FairMoney offers some of the highest limits for unsecured loans.

- Limits: Up to ₦3,000,000.

- Speed: Disbursement usually happens in under 5 minutes.

- Requirement: A smartphone to download the FairMoney MFB app.

4. Carbon (Formerly Paylater)

Carbon has evolved into a full-service digital bank but remains a top choice for instant credit.

- Tenor: Flexible repayment periods from 61 days to 12 months.

- Limits: Up to ₦1,000,000 based on your credit score.

5. Kuda Bank

If you use Kuda as your primary salary account, you can access “Overdrafts” which function as instant mini-loans.

- Benefit: Extremely low interest compared to traditional payday loans.

- Limit: Starts small and increases as you use the account more frequently.

6. Page Financials

Page Financials is known for serving the “working professional.” They offer larger sums than most apps for those with high salaries.

- Max Amount: Up to ₦5,000,000 for qualified applicants.

- Verification: Usually requires a quick check of your Remita or salary bank statement.

7. Moniepoint

While primarily known for POS services, Moniepoint’s personal banking app now offers instant credit to its growing user base. It is particularly useful for those in the informal or semi-formal workforce.

Eligibility Requirements: What You Need to Prepare

While these loans don’t require collateral, they do require you to be “digitally visible.” Here is the checklist for 2026:

- BVN (Bank Verification Number): This is the single most important requirement. It links your identity across all banks.

- Salary Account: Most lenders require your salary to be paid into a bank account for at least 3 to 6 consecutive months.

- Valid ID: National ID (NIN), International Passport, or Voter’s Card.

- Utility Bill: Recent proof of address (often required by microfinance banks).

- Good Credit Score: If you have defaulted on a loan with “App A,” don’t expect to get one from “App B.” The Credit Bureau of Nigeria tracks all defaults.

The 5 Steps to Get Your Loan Disbursed Today

Follow this simple workflow to ensure your application is successful:

1. Check Your Credit Score: Use apps like Carbon or reach out to a credit bureau to ensure you don’t have outstanding debts you’ve forgotten about.

2. Choose the Right Lender: If you need a small amount, go for Kuda or Access Bank USSD. If you need millions, Page Financials or FairMoney are better.

3. Download the App or Use USSD: Ensure you are using the official channel to avoid “loan sharks” and fraudulent apps.

4. Grant Permissions: Most loan apps will ask for permission to read your SMS (to verify transaction alerts) and contacts. In 2026, this is standard procedure for risk assessment.

5. Review the Terms: Look closely at the interest rate and the repayment date. Ensure the “Total Repayment” amount is something you can afford.

Hidden Costs: Interest Rates and Fees

One of the biggest mistakes borrowers make is ignoring the math. Instant loans carry higher interest rates than secured loans because the lender is taking a higher risk.

- Monthly Interest: Usually ranges from 4% to 15%.

- Management Fees: Some banks charge a one-time fee of 1% to 2% upon disbursement.

- Default Charges: If you miss your payment date, the interest can double or triple quickly. Always plan for repayment.

How to Tell if a Loan App is a “Loan Shark”

In 2026, the Federal Competition and Consumer Protection Commission (FCCPC) has cleared many legitimate apps, but some predators still exist. Avoid any app that:

- Asks for an “upfront payment” to process your loan.

- Has no physical office or verifiable website.

- Threatens to contact your friends/family if you are one day late.

- Charges more than 30% interest per month.

Managing Your Debt: Pro Tips for 2026

- Borrow Only What You Need: Just because you are eligible for ₦500,000 doesn’t mean you should take it all if you only need ₦100,000.

- Align Repayment with Payday: Ensure your loan due date is a day or two after your expected salary date to avoid late fees due to bank delays.

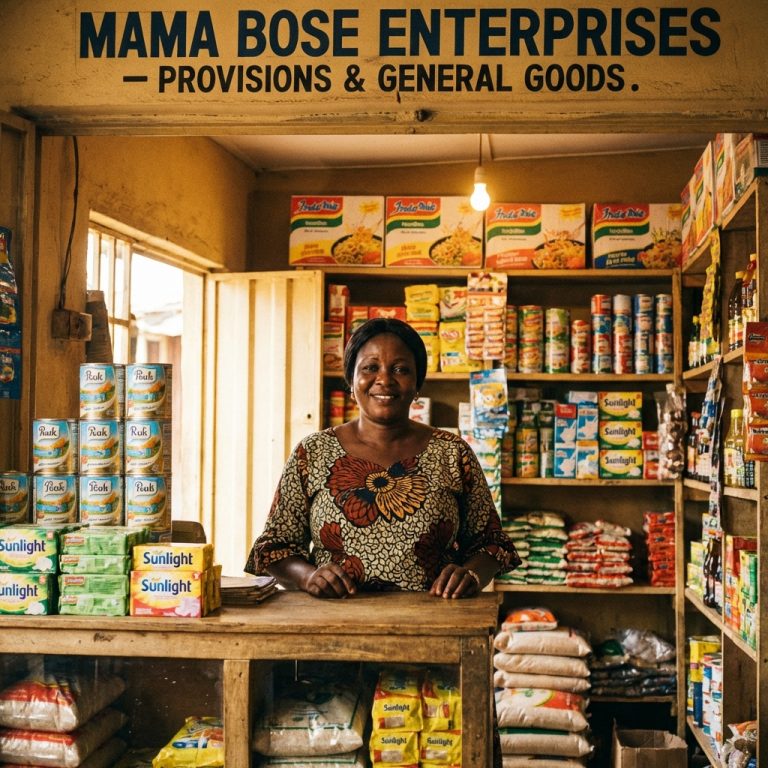

- Use Loans for Productive Purposes: While it’s tempting to use a payday loan for a new phone, it’s better used for emergencies or business inventory that will generate more cash.

Frequently Asked Questions (FAQ)

1. Can I get a loan if I don’t have a job?

Technically, “salary loans” require a job. However, some apps like FairMoney and Carbon offer “personal loans” to self-employed individuals based on their bank transaction volume.

2. How long does it take for the money to enter my account?

On most platforms like Access Bank or Carbon, disbursement happens in 60 seconds to 5 minutes after approval.

3. What happens if I can’t pay back on time?

Your credit score will be damaged, making it impossible to get loans in the future. Additionally, some lenders may report you to the Credit Bureau, and late interest fees will accrue daily.

4. Is my BVN safe with these loan apps?

Legitimate, CBN-licensed banks and Fintechs (like those listed above) use your BVN only for identity verification. Never give your BVN to unverified apps found on social media.

5. Can I have two salary loans at the same time?

It is not recommended and most lenders will reject your application if they see an existing “unpaid” salary loan on your credit report.

6. Are there any loans with 0% interest?

Some Fintechs offer 0% interest on your *very first* small loan (usually under ₦10,000) as a welcome offer. Kuda overdrafts also have very low daily interest rates.

7. Do I need a guarantor for these loans?

No. One of the best parts of instant salary loans in 2026 is that they are guarantor-free.

Conclusion

Instant salary loans without collateral have revolutionized financial inclusion in Nigeria. They provide a much-needed safety net for the working class. However, with great power comes great responsibility. By choosing licensed lenders, understanding the interest rates, and borrowing strictly for needs, you can leverage these tools to maintain financial stability in 2026.

Remember, a loan is a tool, not a lifestyle. Use it wisely, repay promptly, and your credit limit will continue to grow as you build a prosperous future.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.