How Rich is Elon Musk?

How Much Net Worth Elon Musk has in 2025

From Code to Cosmos: How Elon Musk Engineered His Fortune

Elon Musk stands as a titan of modern industry, a figure whose name is synonymous with groundbreaking innovation in electric vehicles, space exploration, and artificial intelligence. His fluctuating, yet consistently astronomical, net worth often places him at the pinnacle of global wealth.

However, the story of how he amassed this fortune is not one of inherited riches or a simple corporate climb; it is a narrative of serial entrepreneurship, audacious risk-taking, and an unconventional approach to wealth built almost entirely on equity and ownership. Understanding his journey requires looking beyond a simple salary and deconstructing how he built and scaled his revolutionary companies.

The Foundation – Seeding the Fortune with Software

Long before Tesla and SpaceX became household names, Elon Musk was a software entrepreneur. After dropping out of a Stanford Ph.D. program, he co-founded his first company, Zip2, in 1995 with his brother, Kimbal.

Zip2 was essentially an online city guide, providing maps and directories to newspapers. In 1999, Compaq acquired Zip2 for over $300 million. Musk’s share, about $22 million, became the seed capital for his next, far more ambitious venture.

He immediately reinvested that capital into his next idea: X.com(no, not Twitter yet…), an online financial services company. Musk envisioned a one-stop shop for all banking needs. In 2000, X.com merged with its main competitor, Confinity, which had a popular money-transfer service called PayPal. Musk became the CEO of the merged entity, which was soon renamed PayPal.

His tenure was fraught with internal battles over the company’s technical infrastructure, leading to his ousting as CEO while he was on vacation. However, he remained the single largest shareholder.

When eBay acquired PayPal in 2002 for $1.5 billion, Musk walked away with approximately $180 million after taxes. This was the critical moment; with a significant fortune in hand, he had the capital to pursue his childhood dreams of space, electric cars, and renewable energy.

The All-In Gamble – Tesla and SpaceX

With his PayPal fortune, Musk did not choose a safe path of diversified investments. Instead, he made two of the riskiest bets in modern business history.

He poured approximately $100 million into SpaceX (Space Exploration Technologies Corp.), which he founded in 2002 with the absurdly ambitious goal of making humanity a multi-planetary species.

A year later, he invested over $70 million into Tesla, Inc., becoming its chairman and largest shareholder.

The late 2000s were brutal. Both companies were burning through cash and teetered on the brink of bankruptcy.

SpaceX suffered multiple launch failures of its Falcon 1 rocket. Tesla was plagued with production problems for its first car, the Roadster, and was hemorrhaging money. By 2008, Musk faced a stark choice: save one company or risk losing both. He famously poured his last remaining personal funds into both ventures. The gamble paid off.

At the eleventh hour, SpaceX secured a crucial $1.6 billion contract from NASA to resupply the International Space Station, and Tesla secured a vital funding round. These moments were the turning point that saved his empire from ruin and set the stage for explosive growth.

The Engine of Wealth – The Tesla Stock Phenomenon

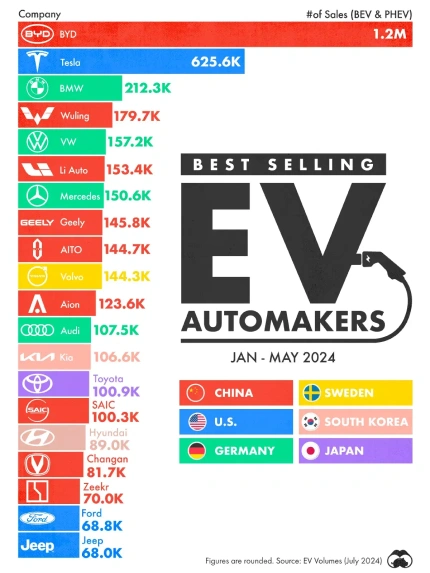

The primary driver of Elon Musk’s ascent to becoming the world’s richest person is the astronomical appreciation of Tesla’s stock ($TSLA). His wealth is directly tied to his significant ownership stake in the company, which has fluctuated but often remained around 20%.

Unlike a traditional CEO who earns a large salary, Musk’s compensation has been almost entirely performance-based.

His groundbreaking 2018 CEO Performance Award is a masterclass in aligning executive pay with shareholder value. The plan stipulated that Musk would receive no salary or cash bonuses.

Instead, he would be granted massive tranches of stock options only if Tesla achieved a series of incredibly ambitious milestones in both market capitalization and operational targets (revenue and profitability).

As Tesla shattered these milestones one by one, growing from a $50 billion company to, at its peak, over a trillion dollars in valuation, Musk unlocked billions in stock options. This structure meant his personal fortune grew in lockstep with the company’s value, making him phenomenally wealthy as Tesla came to dominate the electric vehicle market and expand into energy storage and artificial intelligence.

The Pillars of the Empire – SpaceX and Other Ventures

While Tesla’s public stock provides a volatile, day-to-day measure of his wealth, Musk’s privately held company, SpaceX, is another colossal pillar of his fortune. Because SpaceX is not publicly traded, its value is determined by private funding rounds.

The company has achieved market dominance in the satellite launch industry with its revolutionary reusable rockets (the Falcon 9 and Falcon Heavy), which drastically reduced the cost of accessing space.

Furthermore, its ambitious Starlink satellite internet project is a multi-billion-dollar business in its own right, projecting massive future revenue streams. As a result, SpaceX’s private valuation has soared to well over $150 billion, making Musk’s majority stake in the company an enormous, albeit less liquid, component of his net worth.

Beyond these two giants, Musk has founded or co-founded other ventures that contribute to his portfolio:

- The Boring Company: An infrastructure and tunnel construction company aimed at alleviating urban traffic.

- Neuralink: A neurotechnology company developing implantable brain-machine interfaces.

- X (formerly Twitter): His controversial 2022 acquisition of the social media platform for $44 billion represents a significant investment in the information and communication space.

Deconstructing the Sources of His Fortune

To be clear, Elon Musk’s income is not derived from a paycheck. The source of his wealth is a dynamic combination of factors directly tied to the companies he leads.

- Equity and Ownership: The core of his wealth is his large ownership percentage in his companies. He is not an employee earning a salary; he is a founder and owner whose fortune is a direct reflection of the value of his businesses.

- Stock Price Appreciation: The explosive growth of Tesla’s stock is the single biggest contributor. Every time the share price increases, his personal net worth rises by billions.

- Performance-Based Stock Options: His compensation plan allows him to acquire more shares at a predetermined, much lower price, creating immense wealth as he exercises these options when the market price is high.

- Leverage: Like many of the ultra-wealthy, Musk often avoids selling his stock to generate cash, as this would trigger massive tax bills. Instead, he uses his valuable shares as collateral to take out personal loans, providing him with the liquidity needed to fund new ventures or cover personal expenses.

A Fortune Forged by Vision and Risk

Elon Musk’s journey to becoming the world’s richest person is a testament to a unique financial formula: reinvesting early wins into high-risk, high-reward ventures; shunning traditional salaries in favor of performance-based equity; and tying his personal success directly and inextricably to the success of his companies.

His fortune was not simply earned; it was engineered through a relentless pursuit of ambitious goals, an unwavering belief in his vision, and a financial structure that amplified his success on an unprecedented scale.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.