SME Loans in Nigeria 2026

SME Loans in Nigeria 2026: Complete Guide to Business Financing Without Collateral

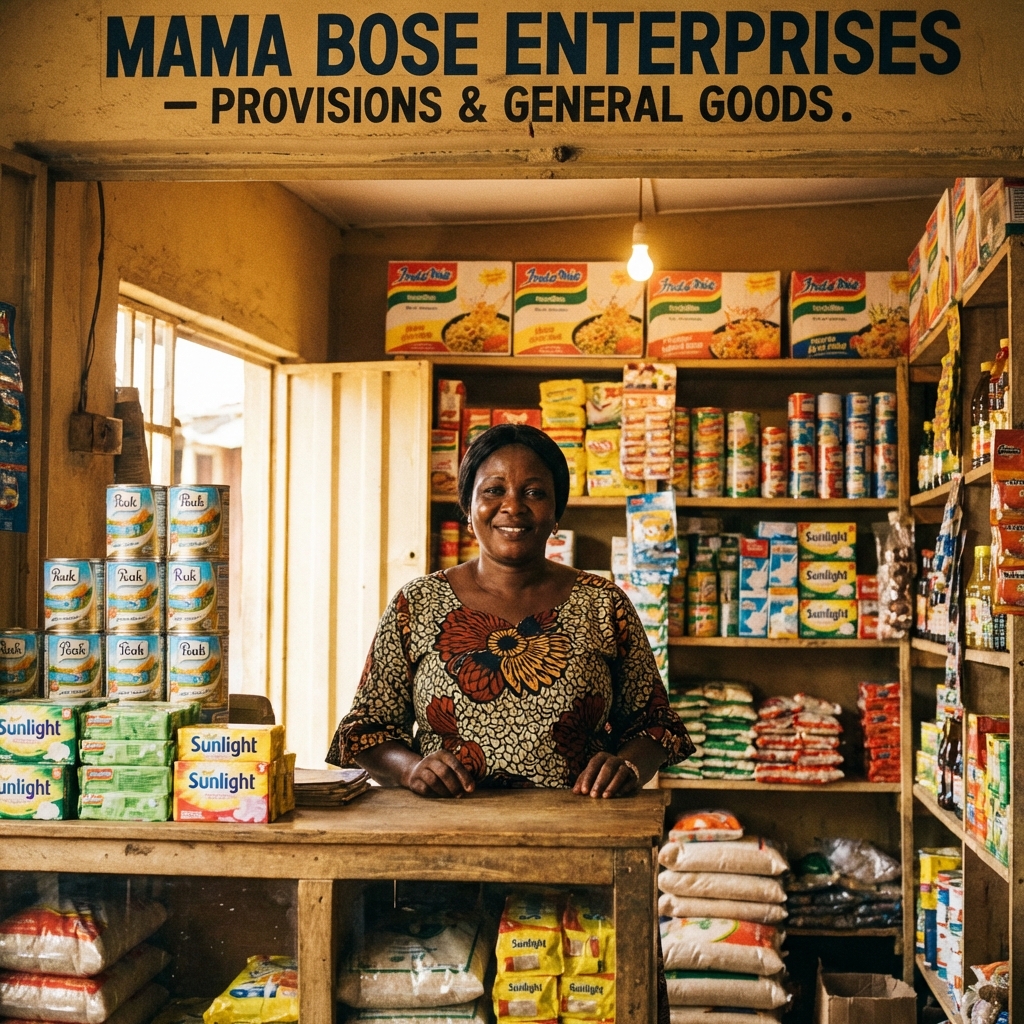

Small and Medium Enterprises (SMEs) are the backbone of Nigeria’s economy, accounting for over 50% of the nation’s GDP and employing more than 80% of the workforce. Yet, access to affordable financing has remained the single biggest obstacle to growth for millions of Nigerian entrepreneurs.

The good news? 2026 brings a wave of new financing options, led by ARM Investment Managers’ landmark ₦200 billion Private Debt Fund and supported by bank recapitalization efforts that are expanding credit availability nationwide.

This comprehensive guide explores every avenue for SME financing in Nigeria, from digital lending platforms to government intervention funds, with a focus on options that do not require traditional collateral.

The ARM ₦200 Billion SME Fund

ARM Investment Managers has launched what is arguably the most significant private sector intervention in SME financing in Nigeria’s history. The ₦200 billion Private Debt Fund specifically targets the financing gap for small and medium-sized enterprises.

Key Features:

- Fund Size: ₦200 billion (approximately $120 million)

- Target Borrowers: Registered SMEs with minimum 2 years of operation

- Interest Rates: Below market benchmark rates (typically 20-25% per annum)

- Tenure: Medium to long-term financing (2-7 years)

- Collateral: Reduced collateral requirements compared to traditional banks

How to Apply:

The fund disburses through partner institutions. Contact ARM Investment Managers directly or inquire through their partner banks (GTBank, Zenith, First Bank) for application details.

bank recapitalization: What It Means for SME Lending

The CBN‘s ongoing bank recapitalization drive is transforming lending capacity in Nigeria. Banks are being required to significantly strengthen their capital base, which in turn expands their ability to lend to small businesses.

Impact on SME Loans:

- Larger loan amounts available (previously, capital constraints limited SME lending)

- More competitive interest rates as banks compete for quality borrowers

- Longer tenures as banks gain confidence in long-term financing

- New SME-focused products emerging from all major banks

Banks with Strong SME Programs in 2026:

- Access Bank: SME Academy with training and financing

- GTBank: Quick Credit for small businesses

- FirstMonie: Agency banking and SME loans integration

- Zenith Bank: SME World with reduced collateral requirements

- Sterling Bank: HEART program for women and youth entrepreneurs

Digital Lenders for Business Financing

Beyond traditional banks, digital lending platforms offer faster, more accessible financing:

| Platform | Max Amount | Interest Rate | Approval Time | Collateral |

|---|---|---|---|---|

| FairMoney SME | ₦3,000,000 | 5-15% monthly | 24 hours | No |

| Carbon Business | ₦2,000,000 | 3-20% monthly | Same day | No |

| Lidya | ₦50,000,000 | 2.5-4% monthly | 24-48 hours | Maybe |

| Lendigo | ₦200,000,000 | Custom | 3-5 days | Yes |

| Cowrywise Evolve | ₦5,000,000 | 4-6% monthly | 48 hours | No |

Best for Startups: FairMoney and Carbon (minimal documentation)

Best for Established SMEs: Lidya and Lendigo (higher amounts, better rates)

Best for Tech Startups: Cowrywise Evolve (designed for tech-forward businesses)

Government Intervention Funds

The Nigerian government operates several programs to support SME growth:

Bank of Industry (BOI) Loans

Overview: Nigeria’s development finance institution offering long-term, low-interest loans

Key Programs:

- BOI Working Capital: Up to ₦500 million at 9% per annum

- BOI Real Sector Support: Manufacturing and agriculture focus

- BOI Fashion Fund: For textile and fashion entrepreneurs

- BOI COVID Recovery Loan: Extended support for pandemic-affected businesses

Requirements:

- Registered business (CAC certificate)

- Minimum 12 months of operation

- Valid tax identification number (TIN)

- Business plan and financial projections

CBN MSMED Fund

Overview: Central Bank of Nigeria’s Micro, Small, and Medium Enterprises Development Fund

Current Programs:

- Interest-free loans for agriculture

- Reduced-rate manufacturing financing

- Women and youth targeted programs

Access: Through participating microfinance banks and commercial banks

NIRSAL Microfinance Bank

Overview: Agricultural-focused lending with strong SME support

Loan Products:

- AgroGeo Loans: GPS-tracked agricultural financing

- SME Working Capital: Short-term business funding

- Women Empowerment: Female entrepreneur focus

How to Get a Business Loan Without Collateral

Many Nigerian entrepreneurs believe that collateral is mandatory for business loans. While traditional banks often require it, several alternatives exist:

Option 1: Invoice Financing

Get funding based on outstanding invoices from reliable customers. Platforms like Lidya and Page Financials specialize in this.

How It Works:

- Submit unpaid invoices from creditworthy customers

- Receive 70-90% of invoice value upfront

- Customer pays invoice at maturity

- You receive remaining balance minus fees

Option 2: Revenue-Based Financing

Loans based on your business transaction history rather than assets.

How It Works:

- Connect your business bank account or POS terminal

- Lender analyzes 6-12 months of transactions

- Loan amount based on average monthly revenue

- Repayment deducted automatically as percentage of daily sales

Platforms Offering This: Paystack Grow, Moniepoint Loans, FirstMonie Advance

Option 3: Peer-to-Peer Lending

Connect with individual investors through regulated platforms.

Popular Platforms:

- Lendigo (also offers institutional loans)

- FundQuest (crowdfunding for businesses)

Option 4: Group-Based Lending

Join or form a borrowing group where members guarantee each other.

How It Works:

- 5-10 business owners form a group

- All members must qualify individually

- Group provides mutual guarantee

- If one defaults, others are responsible

Microfinance banks actively offering group loans: LAPO, Accion, Grooming Centre

Preparing Your Business for Loan Approval

Maximize your chances of approval with proper preparation:

Documentation Checklist

- CAC Certificate of Incorporation

- Business bank statements (6-12 months)

- Tax Identification Number (TIN)

- BVN of all directors

- Business plan or loan purpose statement

- Financial statements (if available)

- Proof of business address (utility bill)

- Valid means of identification

Improving Your Credit Profile

- Clear Outstanding Debts: Pay off any existing loan app balances

- Build Transaction History: Use business account consistently

- Separate Personal and Business Finances: Opens business-only accounts

- Get a DUNS Number: Register with Dun & Bradstreet for business credit

- Join Trade Associations: Membership can serve as soft collateral

Understanding What Lenders Look For

Revenue Stability: Consistent income over 6+ months indicates ability to repay

Profit Margins: Lenders want to see that you can afford additional debt service

Customer Base Diversity: Reliance on few customers is a red flag

Industry Risk: Some sectors (hospitality, entertainment) face higher scrutiny

Owner Experience: Your track record in the industry matters

Interest Rates Comparison: 2026 Landscape

| Lender Type | Interest Range (p.a.) | Best For |

|---|---|---|

| BOI/Government | 5-9% | Long-term, patient capital |

| Commercial Banks | 20-30% | Established businesses with collateral |

| Digital Lenders | 36-120% | Quick, small amounts, no collateral |

| Microfinance Banks | 25-40% | Underserved entrepreneurs |

| Invoice Financing | 24-48% | Businesses with receivables |

Key Insight: Government funds offer the best rates but require more patience and documentation. Digital lenders are fastest but most expensive. The optimal strategy often combines multiple sources.

Sector-Specific Financing Options

Agriculture

- NIRSAL Loans: Specialized agricultural financing

- Anchor Borrowers Programme: Funding through commodity anchor companies

- AGSMEIS: CBN-backed agricultural loans through commercial banks

Technology/Startups

- CcHUB/VC Funding: For high-growth tech startups

- Google for Startups: Non-dilutive grants and equity investment

- Techstars Lagos: Accelerator with funding component

Manufacturing

- BOI Manufacturing Fund: Long-term financing at below-market rates

- NEXIM Bank: Export-focused manufacturing support

- Industrial Parks Integration: Reduced-rate loans for approved industrial zones

Retail/Trading

- TradeDepot Financing: Inventory financing for FMCG distributors

- Alerzo Working Capital: Informal retail sector funding

- Max.ng/Gokada Rider Financing: Asset financing for logistics entrepreneurs

Frequently Asked Questions

Q: What is the minimum revenue needed for a business loan?

A: Most digital lenders require at least ₦500,000 in monthly revenue. Traditional banks often require ₦2-5 million monthly. Government programs may serve businesses with lower revenues.

Q: How long must my business be operational?

A: Digital lenders accept 6-12 months. Commercial banks typically require 2-3 years. Government programs vary but usually require at least 12-24 months.

Q: Can I get a loan with a new CAC registration?

A: Most formal lenders require operational history beyond just registration. However, some programs for startups (like Lagos State LSETF) support newly registered businesses.

Q: What if I do not have an office?

A: Many digital lenders now accept home-based or mobile businesses. Proof of regular business activity (bank transactions, invoices) matters more than physical premises.

Q: Can I apply to multiple lenders at once?

A: Yes, but taking multiple loans simultaneously can hurt your credit score and debt-to-income ratio. Apply to several, accept the best offer, and update your profile before seeking additional financing.

Q: How can I improve my chances without collateral?

A: Focus on building a strong transaction history, provide detailed business plans, offer personal guarantees, and consider group lending or invoice financing options.

Conclusion

2026 presents unprecedented opportunities for Nigerian SMEs to access financing. From the landmark ARM ₦200 billion fund to expanding digital lending options and strengthened bank lending capacity, the tools for growth are now more accessible than ever.

The key to success lies in preparation: understand your options, align your business documentation, build your credit profile, and approach the right lender for your specific needs. Whether you need ₦500,000 for working capital or ₦50 million for expansion, there is a financing solution designed for you.

Do not let lack of traditional collateral stop you. The Nigerian financial ecosystem now offers multiple pathways to funding that recognize business potential beyond just physical assets.

Your business growth story starts with the right financing partner. Begin your search today.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.