SME Survival Guide: 3 Platforms Offering Working Capital Loans

SME Survival Guide: 3 Platforms Offering Working Capital Loans Under 12 Months to Combat Rising Logistics Costs in Lagos

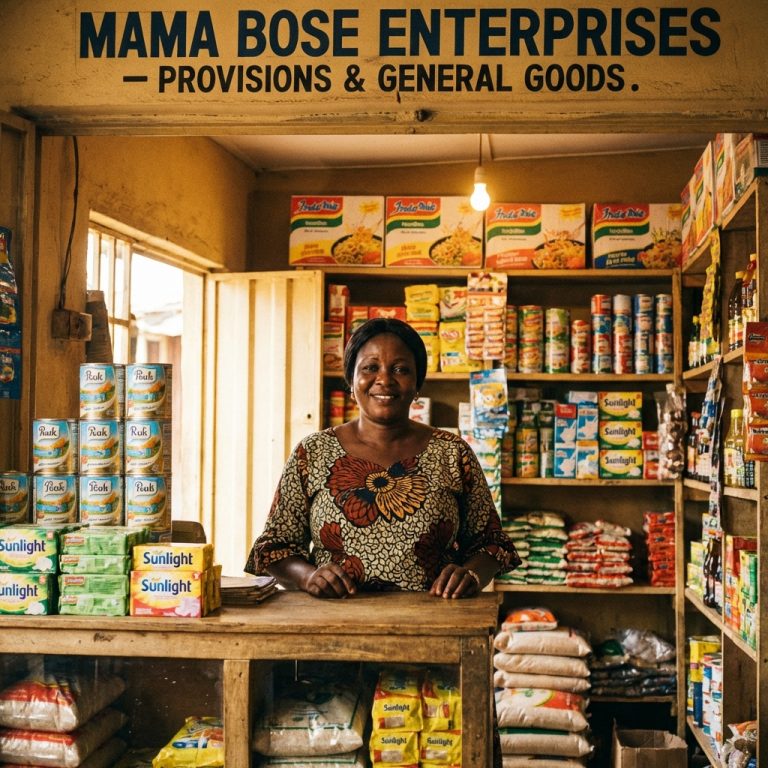

Managing a business in Lagos has never been for the faint-hearted, but 2025 has introduced a new level of complexity: spiraling logistics costs. For Small and Medium Enterprises (SMEs), the movement of goods, whether raw materials from the port at Apapa or finished products to customers in Lekki, has become a major financial drain.

With the price of diesel fluctuating unpredictably, increased freight rates, and the lingering effects of inflation, the cost of keeping goods moving can cripple cash flow. This is where working capital loans come into play. Unlike long-term asset financing, these short-term lifelines (typically under 12 months) are designed to bridge the gap between “goods sent” and “payment received.”

In this survival guide, we navigate the fintech landscape to bring you three reliable platforms offering accessible working capital loans. These options are tailored for Lagos, based SMEs needing speed, flexibility, and minimal bureaucracy to keep their supply chains active.

The Reality of Logistics Costs in Lagos (2025)

Before we dive into the solutions, it is vital to understand the problem. The logistics sector in Lagos is currently battling a “perfect storm”:

- Fuel Price Volatility: Transport costs have risen by over 40% in some sectors compared to previous years, directly affecting margins.

- Traffic & Delays: The perennial Lagos traffic adds hours to delivery times, increasing fuel consumption and reducing vehicle turnaround time.

- Port Congestion: Clearing goods remains expensive and slow, tying up capital that could be used elsewhere.

For an SME, this means one thing: Liquidity is King. You cannot afford to have your cash trapped in transit. You need liquid funds to pay drivers, fuel trucks, and restock inventory immediately.

1. Renmoney: The High-Limit Heavyweight

Renmoney has established itself as a go to microfinance bank for individuals and small businesses looking for substantial support without the rigorous collateral demands of traditional commercial banks.

Key Features for SMEs

- Loan Amount: Up to ₦6,000,000.

- Tenure: Flexible repayment from 3 to 24 months (but easily structured under 12 months for working capital).

- Speed: Disbursal typically happens within 24 hours after approval.

Why It Works for Logistics

If your logistics crunch involves a capital intensive need, such as repairing a delivery van or paying a large lump sum for clearing goods, the higher limit of N6 million is invaluable. Renmoney’s process is largely digital, reducing the need for physical visits.

Pros:

- High loan limits compared to other digital apps.

- No collateral is required for many operational loans (based on turnover history).

- Transparent interest rates.

Cons:

- Strict eligibility criteria regarding bank statement history.

- Interest rates can be higher than traditional banks (though faster to access).

2. FairMoney: The Speed Demon

Checking the “need for speed” box effectively, FairMoney is a digital bank that specializes in instant lending. For an SME owner stuck at a filling station or needing to pay a dispatcher now, FairMoney is often the fastest route.

Key Features for SMEs

- Loan Amount: SME loans typically range from ₦10,000 to ₦3,000,000 (depending on credit history).

- Tenure: Short-term focus, typically 2 weeks to 12 months.

- Interest: Monthly rates starting from roughly 3% to 10% depending on risk profile.

Why It Works for Logistics

FairMoney is perfect for “micro-shocks”, sudden expenses that threaten to halt operations for the day. Maybe a bike broke down, or you need to pay an urgent toll/levy. The application is entirely smartphone-based, uses AI for credit scoring, and disburses funds in minutes.

Pros:

- Blistering fast approval and disbursement (often under 5 minutes).

- No paperwork; entirely app based.

- Good for building credit history for larger future loans.

Cons:

- Loan amounts may start small until you build a reputation.

- Short tenures can result in high pressure if cash flow is delayed.

3. Lendha: The Logistics Specialist

Unlike general, purpose lenders, Lendha has carved a niche specifically targeting the supply chain and trade sector. They understand that a distributor waiting for goods is a safe bet, making them uniquely suited for this list.

Key Features for SMEs

- Loan Amount: Up to ₦10,000,000 (varies by product).

- Tenure: Typically 1 to 6 months (perfect for working capital cycles).

- Focus: Distributors, Retailers, and Logistics partners.

Why It Works for Logistics

Lendha’s algorithm specifically looks at your trade volume and inventory. They offer “Stock Financing” and direct working capital. If you are a distributor in Lagos struggling to move stock due to transport costs, Lendha speaks your language. They are less focused on your generic “salary” and more on your business turnover.

Pros:

- Higher limits (up to N10m) for verified businesses.

- Supply-chain specific understanding reduces rejection rates for traders.

- Competitive rates for short-term cycles.

Cons:

- May require more business documentation than a simple “instant loan” app.

- Geographic and sector focus might limit some service based SMEs.

Comparative Snapshot

| Feature | Renmoney | FairMoney | Lendha |

|---|---|---|---|

| Best For | Large One-off Expenses | Emergency Cash / Repairs | Inventory & Movement |

| Max Amount | ~₦6 Million | ~₦3 Million | ~₦10 Million |

| Speed | 24 Hours | Minutes | 24-48 Hours |

| Tenure | 3 – 24 Months | 2 Weeks – 12 Months | 1 – 6 Months |

Survival Tips for Getting Approved

Getting the loan is half the battle; repaying it without sinking your profits is the other.

- Keep Digital Records: All these platforms rely on data. If you transact with cash, deposit it into your corporate account immediately. They need to see the turnover in your bank statement.

- Borrow Only for “Revenue Generating” Activities: Do not borrow to pay rent. Borrow to clear goods or fuel trucks, activities that will immediately generate the cash to repay the loan.

- Watch the APR: For loans under 12 months, calculate the total interest cost and compare it to the profit margin of the goods you are moving. If the logistics cost + loan interest > profit, do not move the goods.

Beyond Loans: 5 Strategic Ways to Lower Your Logistics Bill

While securing working capital is a vital defensive move, the best offense is to structurally reduce your logistics exposure. As you prepare your loan application, consider implementing these changes to make your new capital go further.

1. Consolidate Your Shipments

The era of “Just-in-Time” delivery is becoming expensive in Lagos. Instead of sending three half-empty dispatch bikes to the mainland in one day, consolidate your orders. Offer customers a slight discount for “Next Day Delivery” instead of “Same Day.” This allows you to batch orders and fill a single vehicle, significantly reducing the cost per unit.

2. Negotiate “Return Leg” Rates

Many trucks return empty after delivering goods. In logistics terms, this is “dead mileage.” If you have a regular route (e.g., Ikeja to Badagry), find a logistics partner who delivers *to* Ikeja and returns empty. Negotiating a “backhaul” rate can save you up to 30% compared to booking a fresh one way trip, as the driver is desperate to cover their fuel for the return journey.

3. Decentralize Your Warehousing

If 80% of your customers are in Lekki, why is your warehouse in Ogba? The cost of constantly moving goods across the Third Mainland Bridge adds up. Consider using “micro warehousing” or shared fulfillment centers closer to your key customer clusters. The rent for a small shared space might be lower than the cumulative cost of fuel and delivery delays.

4. Invest in Packaging

It sounds counterintuitive, but improved packaging reduces damage in transit. In Lagos, goods are often handled roughly. A 5% loss in inventory due to breakage during transit is a 5% direct hit to your bottom line. Stronger, stackable packaging ensures more goods fit in a van and fewer goods arrive damaged, preserving your capital.

5. Audit Your Logistics Partners

Loyalty is good, but blind loyalty is expensive. Audit your delivery partners every quarter. Are their prices tracking with fuel subsidies? Are they surcharging you for “delays” that are their fault? Benchmarking your current provider against new entrants (who might be hungry for business) can reveal significant savings.

The Application Process: A Step-by-Step Guide

To ensure you don’t waste time with rejections, here is a granular guide to applying for these digital loans.

Step 1: The Digital Audit

Before you download any app, look at your phone. Is your BVN linked to your phone number? Do the names on your bank account match your ID exactly? Inconsistencies here are the #1 cause of automated rejection. Fix them at the bank before starting.

Step 2: Activity Ramp-Up

If you plan to apply in two weeks, spend the next 14 days actively using your corporate account. If you normally accept cash, stop. Force all payments through the account. These algorithms look for “velocity”, the frequency of transactions, as much as the volume. A dormant account that suddenly receives N1 million looks suspicious; an active account looks healthy.

Step 3: The “Soft” Application

Start with the app that requires the least frictional cost. Apply to FairMoney or Carbon for a small amount first to test your credit score. If approved instantly, it’s a green light that your credit profile is healthy. You can then approach Renmoney or Lendha for the larger “heavy lifting” capital.

Step 4: Documentation Prep (For Lendha/Renmoney)

Have these ready as PDF files on your phone:

- CAC Certificate (BN/RC Number).

- Valid Government ID (Passport/NIN/Voters Card).

- Utility Bill (Proof of office/home address not older than 3 months).

- 6 Months Bank Statement (generated via your bank app).

Step 5: The Disbursement Strategy

Once approved, do not withdraw the cash to sit in a drawer. Transfer it directly to your logistics partner or supplier. This creates a digital trail showing the loan was used for business, which helps your credit rating for future, larger application rounds.

Frequently Asked Questions (FAQ)

Q1: Do these platforms require collateral?

A: Generally, no. Renmoney, FairMoney, and Lendha focus on “unsecured” lending, using your bank statement history and credit score (via credit bureaus) to make decisions. However, for the highest tier amounts (e.g., N10m with Lendha), some form of business guarantee might be requested.

Q2: Can I apply if my business is not registered with CAC?

A: It is difficult. While FairMoney might lend to you as an individual (personal loan used for business), getting higher SME limits from Renmoney or Lendha strictly requires CAC registration and a corporate bank account.

Q3: How fast can I get the money?

A: FairMoney is the fastest (minutes). Renmoney typically takes 24 hours. Lendha may take 24-48 hours as they may verify your business nature.

Q4: Are the interest rates fixed?

A: Interest rates are usually fixed for the duration of the loan once agreed upon, but the rate offered to you depends on your risk profile. A business with steady daily income will get a cheaper rate than one with sporadic deposits.

Q5: What happens if I default due to a logistics delay?

A: Communication is key. Digital lenders report to Credit Bureaus (CRC, FirstCentral). A default will ruin your credit score, making it impossible to borrow from any bank in the future. If a truck release is delayed, contact the lender before the due date.

Conclusion

The rising cost of logistics in Lagos is a formidable challenge, but it is not an insurmountable one. By leveraging the agility of fintech platforms like Renmoney, FairMoney, and Lendha, smart SMEs can inject the necessary liquidity into their operations to keep the wheels turning.

The era of waiting weeks for a bank manager to approve an overdraft is fading. In 2025, survival belongs to the adaptable, those who can secure funding in hours, move their goods instantly, and turn a profit despite the headwinds. Evaluate your needs, choose the platform that aligns with your cycle, and ensure your logistics strategy helps you survive and thrive.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.