Top 10 Best Credit Cards in the World (2025)

Top 10 Best Credit Cards in the World (2025) – Features, Benefits & How to Qualify

Top 10 Best Credit Cards in the World (2025 Edition)

In today’s global economy, the best credit cards in the world go beyond simple spending — they represent prestige, power, and opportunity. These cards grant access to exclusive travel perks, luxury experiences, and elite financial services.

Below, explore the top 10 most prestigious credit cards of 2025, why they stand out, and what it takes to qualify for one.

1. American Express Centurion Card (Black Card)

Why It’s the Best: The Amex Centurion remains the world’s most exclusive card, available by invitation only to individuals with exceptional spending power.

Benefits:

- No preset spending limit.

- 24/7 concierge and lifestyle management.

- VIP access to hotels, events, and travel services.

- Extensive travel insurance and purchase protection.

Eligibility: Invitation-only for top-tier American Express clients, typically spending over $250,000 per year.

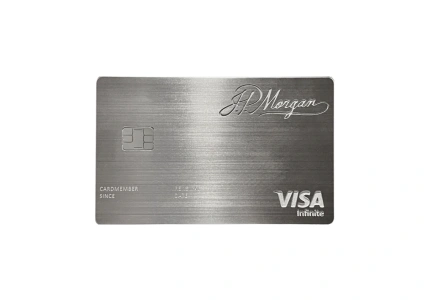

2. J.P. Morgan Reserve Card

Why It’s the Best: Crafted from palladium, the J.P. Morgan Reserve is reserved for clients of the Private Bank, offering unmatched service and luxury.

Benefits:

- Priority Pass access to airport lounges.

- Personalized wealth management services.

- Comprehensive travel coverage and fraud protection.

Eligibility: Requires at least $10 million in assets managed by J.P. Morgan Private Bank.

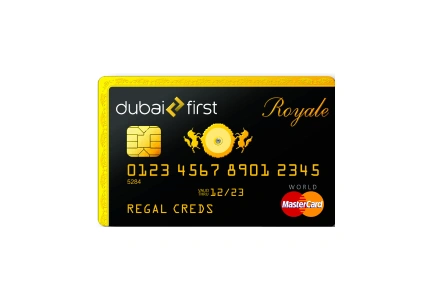

3. Dubai First Royale Mastercard

Why It’s the Best: With a diamond centerpiece and gold trim, the Dubai First Royale Mastercard is a true symbol of power and status.

Benefits:

- Unlimited credit capacity.

- Personalized relationship managers.

- Bespoke lifestyle services for travel and luxury events.

Eligibility: Offered by invitation only to members of royal families and high-net-worth individuals.

4. Chase Sapphire Reserve

Why It’s the Best: The Chase Sapphire Reserve offers premium benefits and a strong rewards program, making it ideal for frequent travelers.

Benefits:

- 3x points on dining and travel.

- $300 annual travel credit.

- Complimentary airport lounge access.

- Strong travel and purchase protection policies.

Eligibility: Requires excellent credit and a stable high income.

5. Citi Prestige Card

Why It’s the Best: The Citi Prestige provides value for global travelers through its generous hotel and airline perks.

Benefits:

- Fourth-night-free hotel stays.

- 5x points on air travel and dining.

- Global Entry / TSA PreCheck credit.

- Worldwide Priority Pass access.

Eligibility: Suitable for professionals with strong income and credit history.

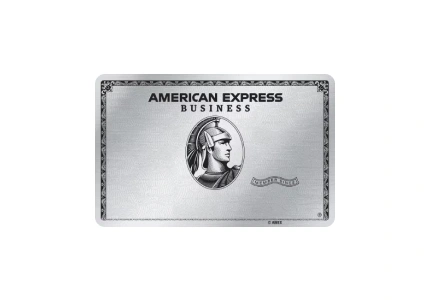

6. American Express Platinum Card

Why It’s the Best: The Amex Platinum delivers a balance of travel, lifestyle, and financial rewards unmatched in the premium category.

Benefits:

- 5x points on flights and prepaid hotels.

- Access to 1,400+ lounges worldwide.

- Annual statement credits for travel and lifestyle purchases.

- Complimentary elite status with major hotel brands.

Eligibility: Available to users with excellent credit and the ability to pay the $695 annual fee.

7. Stratus Rewards Visa (White Card)

Why It’s the Best: The Stratus Visa, also called the “White Card,” caters to jetsetters and entrepreneurs seeking exclusive privileges.

Benefits:

- Discounts on private jet services.

- Access to exclusive events and member networks.

- Concierge support for bespoke travel and dining.

Eligibility: Invitation-only, usually extended to high-spending professionals.

8. Mastercard World Elite

Why It’s the Best: The Mastercard World Elite offers premium global perks at a more accessible level.

Benefits:

- Comprehensive travel insurance and concierge services.

- Airport lounge access and hotel upgrades.

- Cashback and flexible redemption options.

Eligibility: Applicants with good to excellent credit qualify.

9. HSBC Premier World Elite Mastercard

Why It’s the Best: Tailored for international professionals, this card offers seamless global financial access.

Benefits:

- No foreign transaction fees.

- Priority Pass lounge membership.

- Strong fraud protection and travel coverage.

Eligibility: Reserved for HSBC Premier clients with qualifying balances or investments.

10. Coutts Silk Card

Why It’s the Best: The Coutts Silk Card is issued by one of the UK’s oldest private banks, known for serving royalty and business leaders.

Benefits:

- Personalized financial planning and concierge services.

- VIP access to exclusive cultural and sporting events.

- Flexible spending limits.

Eligibility: Available only to Coutts private banking clients with assets over £1 million.

How to Qualify for a Luxury Credit Card

Owning one of these cards requires more than wealth — it demands discipline, credibility, and strategy.

1. Build Excellent Credit

Keep your credit utilization below 30%, pay balances early, and maintain a strong payment history.

2. Increase Your Net Worth

Invest in businesses, real estate, crypto and financial portfolios to grow assets and qualify for private banking relationships.

3. Develop a High-Income Career or Business

Elite cards are commonly offered to entrepreneurs, executives, and professionals with consistent high income.

4. Educate Yourself in Finance

Formal education in business, finance, or economics enhances decision-making and credibility with institutions.

5. Build Relationships with Banks

Invitation-only cards often come through referrals or long-term partnerships with your bank or financial advisor.

From Aspiration to Achievement

The top 10 best credit cards in the world represent financial sophistication and global access. Whether it’s the Amex Centurion or the J.P. Morgan Reserve, these cards are not just about spending — they are about opportunity, status, and financial intelligence.

By working strategically, studying continuously, and building strong financial foundations, you can move closer to qualifying for one of these prestigious credit cards — and enter the world of global financial excellence.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.