Top 10 Highest Interest Savings Accounts in Lagos

Top 10 Highest Interest Savings Accounts in Lagos: Maximizing Naira Yields in November 2025

The contemporary Nigerian financial environment, characterized by persistent inflation and elevated interest rates, necessitates a strategic and active approach to personal wealth management. Savers in Lagos, the nation’s commercial nerve center, must critically evaluate available financial products to ensure their capital not only grows nominally but, more importantly, secures a positive real-terms return against inflation. Top 10 Highest Interest Savings Accounts in Lagos: Maximizing Naira Yields in November 2025 is an compreensive list of the best.

The Economic Imperative: Understanding Real Returns

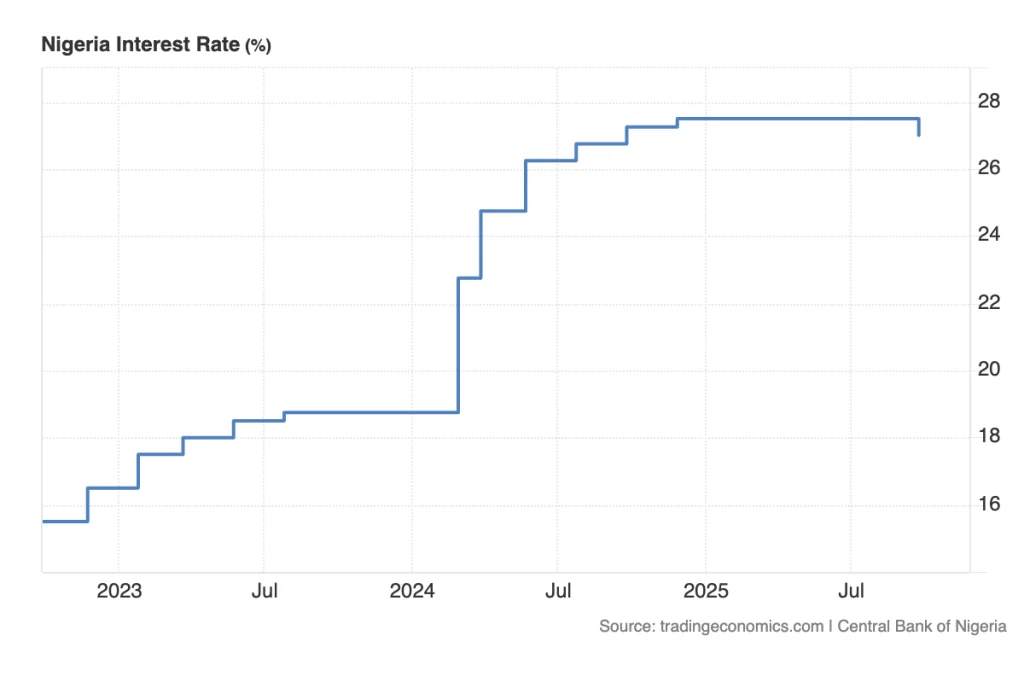

To effectively maximize Naira yields, investors must first comprehend the true enemy of savings: inflation. As of October 2025, the national inflation rate stood at 16.05%. This figure represents the crucial benchmark; any financial instrument offering a return below 16.05% is, in reality, ensuring a loss of purchasing power for the investor.

The Central Bank of Nigeria’s (CBN) aggressive tightening, holding the Monetary Policy Rate (MPR) at 27.00%, has, however, created a unique high yield environment where positive real returns are genuinely attainable, particularly through digital and fixed-income assets.

Digital Dominance – Secure Digital Savings Platforms Nigeria

The most competitive returns in the consumer savings market originate from the highly regulated, innovation driven digital banks and FinTech platforms. These entities leverage technological efficiency to offer premium yields, distinguishing themselves sharply from conventional commercial banks.

The following three platforms currently lead the market, specializing in fixed or locked savings to secure the highest savings interest rates Nigeria.

1. FairMoney Microfinance Bank – FairLock Product

- Maximum Annual Interest: Up to 28% p.a.

- Structure: FairLock requires funds to be locked for a fixed tenor (e.g., 7 days up to 24 months). The rate is tiered, rewarding longer commitments.

- Security: FairMoney operates as a regulated Microfinance Bank (MFB) and offers NDIC insurance on deposits, establishing it as one of the secure digital savings platforms Nigeria.

- Real Return vs. Inflation (16.05%): +11.95% (Significantly Positive)

2. Renmoney – RenVault

- Maximum Annual Interest: Up to 28% p.a.

- Structure: RenVault is designed for fixed-term deposit locking. The platform offers highly competitive rates, often rivaling FairMoney’s top yields, with interest potentially payable upfront or at maturity, enhancing the financial benefit.

- Security: Renmoney is regulated by the CBN and is a verified financial service provider, reinforcing its status within secure digital savings platforms Nigeria.

- Real Return vs. Inflation (16.05%): +11.95% (Significantly Positive)

3. PiggyVest – SafeLock

- Maximum Annual Interest: Up to 22% p.a.

- Structure: SafeLock is PiggyVest’s dedicated fixed-term product, popular for disciplined saving. Funds can be locked for periods ranging from 90 to 365 days. A distinguishing feature is that the full interest is often paid upfront into the flexible wallet.

- Security: PiggyVest is SEC-regulated, commanding high trust among users and firmly categorized among secure digital savings platforms Nigeria.

- Real Return vs. Inflation (16.05%): +5.95% (Positive)

Sovereign Security – FGN Bond vs T-Bill returns Lagos

For conservative investors prioritizing zero default risk, government securities serve as the ultimate benchmark. Both Federal Government of Nigeria (FGN) Bonds and Nigerian Treasury Bills (T-Bills) are backed by the full faith and credit of the Federal Government, making them the safest available investment options. Their yields have also escalated due to the high MPR.

FGN Bonds (Federal Government Bonds)

- Typical Yields (November 2025): 18% – 24% (depending on the long tenor, often 2 to 30 years).

- Key Feature: Bonds pay interest (coupons) semi-annually. They are tradable on the Nigerian Exchange (NGX) and require a high minimum subscription (often over ₦50 million in the primary market, though lower access is possible through the secondary market).

- Real Return Potential: Up to +7.95%.

Nigerian Treasury Bills (T-Bills)

- Typical Yields (November 2025): 15% – 22% (depending on short tenor, e.g., 91-day to 364-day).

- Key Feature: T-Bills are short term instruments. Investors earn interest upfront (the difference between the purchase price and the face value). They provide superior liquidity compared to bonds.

- Real Return Potential: Up to +5.95%.

The comparison of FGN Bond vs T-Bill returns Lagos confirms that both instruments provide a positive real return, but bonds (with longer tenors) may offer the marginal maximum yield, albeit with higher capital commitment and lower liquidity.

Section 3: Conventional Banking vs. Digital Yields

It is crucial to highlight the severe disparity between innovative digital yields and the interest rates offered by most conventional banks on standard savings accounts.

- Traditional Savings Accounts (Tier-1 Banks): Average interest rates hover around 8% – 9% p.a. (e.g., Standard Chartered eSaver offers up to 9%).

- Real Return Analysis for Traditional Accounts: A nominal 9% return yields a real return of 9% – 16.05% = -7.05%.

This pronounced negative real terms return explicitly demonstrates that keeping large amounts of capital in standard savings accounts is actively detrimental to wealth preservation in the current economic climate.

Top 10 High-Yield Platforms in Lagos (November 2025)

This table summarizes the best avenues for maximizing Naira yields, offering a practical resource for investors in Lagos.

| Rank | Platform/Product | Type | Max Annual Nominal Rate (p.a.) | Real Return (vs. 16.05% Inflation) | Key Advantage |

| 1 | FairMoney FairLock | Digital Fixed Deposit | 28.00% | +11.95% | Highest Verified Return |

| 2 | Renmoney RenVault | Digital Fixed Deposit | 28.00% | +11.95% | Competitive Upfront Interest |

| 3 | FGN Bonds (Long Tenor) | Government Security | ~24.00% | +7.95% | Zero Default Risk |

| 4 | PiggyVest SafeLock | Digital Fixed Savings | 22.00% | +5.95% | SEC-Regulated, Interest Upfront |

| 5 | 364-Day Treasury Bills | Government Security | ~22.00% | +5.95% | Highly Liquid, Sovereign Guarantee |

| 6 | Cowrywise Target Savings | Digital Fixed Savings | 18.00% | +1.95% | Automated, SEC-Regulated |

| 7 | DLM Fixed Savings | Investment/Asset Mgmt | 15.00% | -1.05% | Competitive Traditional Fixed |

| 8 | Kuda Bank Fixed Savings | Digital Microfinance | 12.00% | -4.05% | Ease of Use, Instant Access |

| 9 | Providus Bank High Yield | Traditional MFB Deposit | 10.00% | -6.05% | Higher Minimum Balance Required |

| 10 | Standard Chartered eSaver | Traditional Bank Savings | 9.00% | -7.05% | Traditional Bank Stability |

Frequently Asked Questions (FAQ)

1. What is a “Positive Real Terms Return”?

A positive real terms return means the interest rate you earn on your savings is higher than the rate of inflation. As the current inflation rate is 16.05%, any investment yielding more than 16.05% is actively growing your purchasing power. Anything less is resulting in a loss of real wealth.

2. How secure are these Digital Savings Platforms in Nigeria?

The top platforms like FairMoney, Renmoney, and PiggyVest are highly regulated. FairMoney and Renmoney operate under Microfinance Bank licenses with NDIC insurance, and PiggyVest is regulated by the Securities and Exchange Commission (SEC). This oversight establishes them as secure digital savings platforms Nigeria can trust.

3. What is the key difference between FGN Bonds and T-Bills?

The primary distinction lies in tenor and liquidity. FGN Bonds are long term (2-30 years) and pay interest semi annually, requiring a higher capital commitment. T-Bills are short-term (up to 364 days) and pay interest upfront, offering superior liquidity and lower capital entry points. Both instruments maintain a zero default risk sovereign guarantee.

4. Why should I move money out of my Traditional Bank Savings Account?

Traditional Tier 1 bank savings accounts typically offer low nominal rates (e.g., 9% p.a.). When compared to the 16.05% inflation rate, these accounts generate a negative real terms return of around -7.05%. This means your money is losing value quickly, actively diminishing your purchasing power.

Strategic Allocation for Naira Yields

The data unequivocally demonstrates that secure digital savings platforms Nigeria offer the most competitive returns, with FairMoney and Renmoney currently leading the market by providing a substantial positive real return.

Investors operating in Lagos must actively shift capital away from traditional bank savings, which demonstrably fail to preserve purchasing power. While FGN Bond vs T-Bill returns Lagos provides superior safety and positive real returns, the FinTech fixed-deposit products offer the highest potential yield in the short to medium term.

The successful maximization of Naira yields this November requires an intentional allocation strategy that balances the liquidity of T-Bills, the certainty of Bonds, and the high interest of regulated digital platforms.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.