Why Nigerians Are Turning to Loan Apps Faster Than Ever

Why Nigerians Are Turning to Loan Apps Faster Than Ever

Nigeria’s financial environment is changing at a remarkable pace. In previous years, many people relied on banks, cooperatives, employers, and family networks for financial support. Today, millions of Nigerians are choosing loan apps, digital platforms offering instant credit without the stress of paperwork or long bank queues.

This rapid shift is driven by economic pressure, lifestyle changes, technological advancements, and the growing need for fast, convenient financial solutions. Understanding why Nigerians are turning to loan apps faster than ever reveals deep insights into the country’s financial behavior and digital transformation.

The Rise of Digital Lending in Nigeria

Over the last few years, digital lending has expanded significantly across Nigeria. Apps such as Branch, FairMoney, Carbon, PalmCredit, Okash, and Aella Credit dominate the consumer lending market.

Their widespread adoption is driven by:

- Increasing smartphone ownership

- Cheaper data bundles

- A youthful, tech oriented population

As digital connectivity spreads, loan apps offer a modern, easy alternative to traditional financial institutions.

Economic Pressures Are Increasing Loan App Usage

Nigeria’s economic climate is one of the biggest reasons for the surge in digital borrowing. Inflation, rising food prices, currency fluctuations, and high unemployment place intense pressure on households.

Many Nigerians struggle with:

Irregular income

Sudden expenses

Low savings

High living costs

Small loans, ₦5,000, ₦10,000, or ₦20,000, help people cover urgent needs like groceries, transport, school fees, and utilities.

Traditional Banks Are Too Slow and Complicated

Banks remain important, but their lending processes do not match the urgency of modern financial needs. Nigerians often face:

Heavy documentation

Slow processing times

Collateral requirements

Strict eligibility rules

Low approval rates

More than 90% of Nigerians work in the informal sector, making them ineligible for most bank loans. Loan apps, however, provide instant credit without demanding collateral.

Loan Apps Offer Instant Cash With Minimal Requirements

The biggest attraction of loan apps is the speed and simplicity of accessing funds. Most apps disburse money within minutes.

The basic requirements include:

A smartphone

A BVN

A bank account

A valid ID

Good repayment behavior

Compared to banks, this is significantly easier and faster, making digital lending ideal for emergencies.

Fintech Innovation Enables Smarter Lending

Nigeria’s fintech ecosystem is among the most advanced in Africa. Loan apps use AI, machine learning, and alternative data to approve loans without requiring collateral.

These systems analyze:

Phone usage data

Bank SMS alerts

Transaction patterns

Device behavior

Repayment history

This modern credit scoring model allows faster approvals and fairer access to credit for both salaried and informal workers.

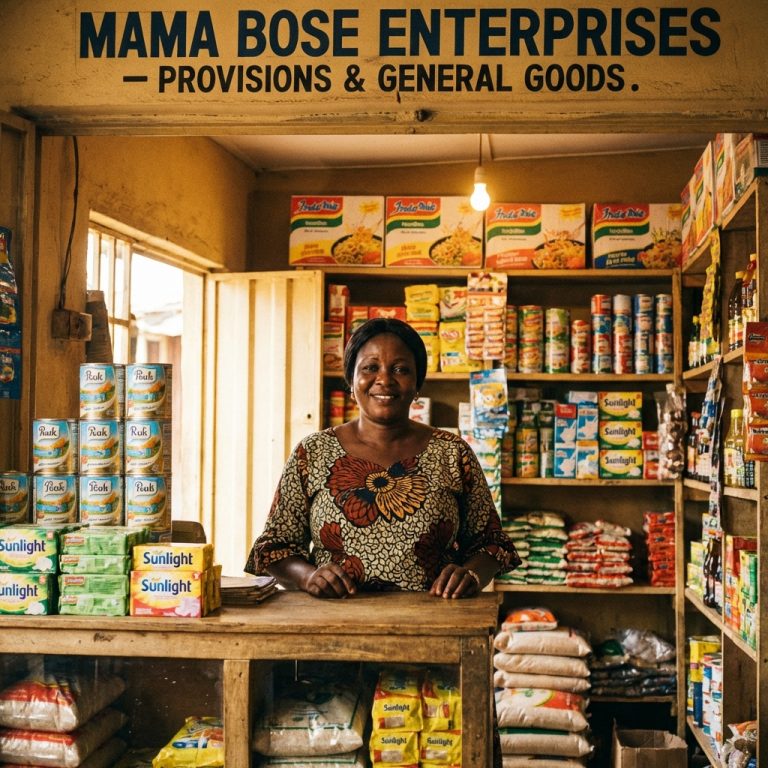

Loan Apps Support the Informal Workforce

Nigeria’s economy is largely informal. Millions of people earn daily income from:

Market trading

POS services

Transport business

Freelancing

Artisan work

Small retail shops

Traditional banks cannot evaluate such irregular income. Loan apps use flexible risk assessment, making them ideal for informal earners who need quick access to credit.

Young Nigerians Prefer Digital First Solutions

Nigeria has one of the youngest populations globally. This youth driven demographic prefers mobile-first financial solutions.

Younger Nigerians choose loan apps because they offer:

Instant results

In-app repayment

No face-to-face interactions

Digital transparency

Lifestyle convenience

Loan apps match the speed and simplicity younger Nigerians expect.

Loan Apps Provide Flexible Repayment Options

Loan apps offer flexible terms such as:

Weekly or monthly repayment

Loan extensions

Higher limits after good repayment behavior

Digital reminders and tracking

Traditional banks rarely allow such flexibility, especially for small loans.

Growing Public Trust in Digital Platforms

Nigerians trust loan apps more today because:

Fintech regulations are strengthening

Platforms display reviews and ratings

Borrowers have better digital literacy

Apps offer customer support

Reputable brands are entering the space

Even though concerns like high interest and rude debt collection still exist, trust is growing overall.

Pros and Cons of Loan Apps in Nigeria

| Pros | Why It Matters |

|---|---|

| Instant approval and quick cash | Helps during emergencies or urgent expenses. |

| No collateral required | Good for informal workers without assets. |

| Simple, digital application process | No paperwork or bank visits. |

| Flexible repayment options | Suitable for people with unstable income. |

| Builds digital credit history | Leads to higher loan limits over time. |

| Cons | Impact |

|---|---|

| High interest rates | Can cause financial stress or debt cycles. |

| Short repayment periods | Pressure on borrowers with inconsistent income. |

| Aggressive debt collection from unlicensed apps | Harassment and privacy violations. |

| Data privacy risks | Some apps misuse personal info. |

| Risk of addiction to borrowing | Easy access may create unhealthy financial habits. |

Frequently Asked Questions (FAQ)

Are loan apps safe to use?

Many regulated apps are safe. Always choose licensed lenders with verified customer support and clear privacy policies.

Why do loan apps have high interest rates?

They take more risk by offering unsecured loans without collateral, so they charge higher interest to cover potential losses.

Can loan apps build my credit history?

Yes. Timely repayment improves your digital credit score, unlocking higher limits.

Do loan apps report defaulters to credit bureaus?

Most licensed apps report default cases, which can affect your ability to borrow in the future.

Do I need collateral or guarantors?

No. Most loan apps are fully collateral free.

Conclusion

Nigerians are turning to loan apps faster than ever because these platforms provide speed, simplicity, and accessibility unmatched by traditional banking systems. With economic pressures rising and financial emergencies becoming more frequent, instant digital loans offer immediate relief.

Loan apps democratize credit, empower informal workers, and embrace modern technology. However, borrowers must remain cautious, choose regulated platforms, and avoid over borrowing to stay financially healthy.

I enjoy reading, chess, writing, and creating things for the internet. Since I was a child, I wanted to create meaningful things. Here, I found my purpose.